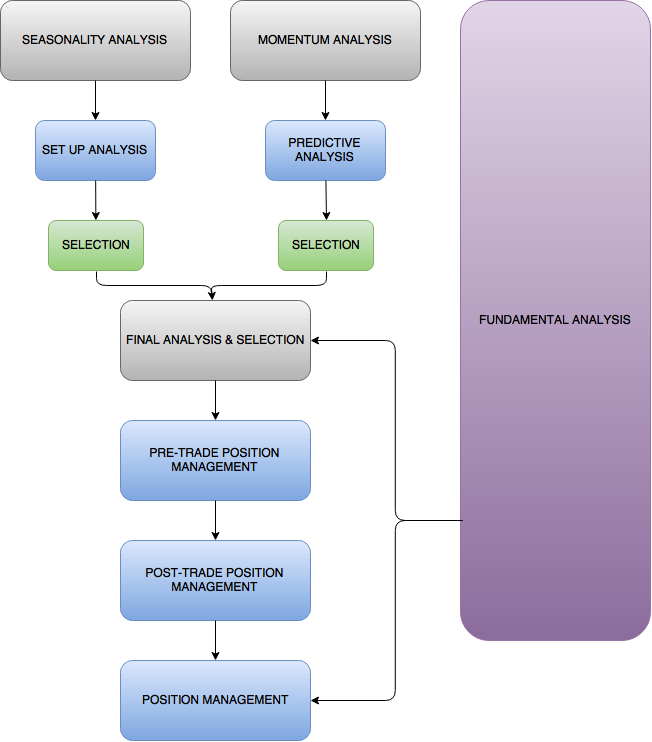

At CastleMoore we manage client assets through a methodical and disciplined set of systems. We remove industry assumptions and individual portfolio manager bias, and focus on a multifaceted top down or “big picture” investment methodology.

Our process is grounded in long and mid-term trend identification, valuation and loss avoidance techniques. Our decisions are filtered through technical, fundamental and seasonal analysis. Together, the research and results frames and influences our primary macro-economic view, and specific investment choices for client portfolios.

This process provides clients with portfolios that have less risk, increased stability and more predictability. Another important effect of our methodology is that portfolios are adaptive and flexible and free from a fixed, unchanging view of the global investment landscape.